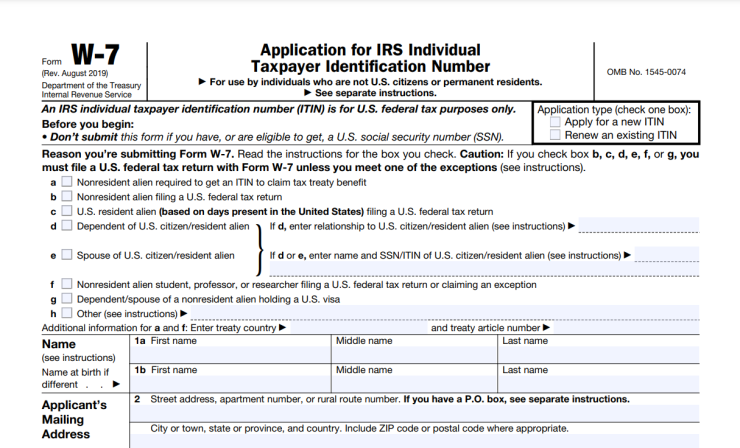

ITIN Application

Use Form W-7 to apply for an IRS individual taxpayer identification number (ITIN). You can also use this form to renew an existing ITIN that is expiring or that has already expired.

An ITIN is a 9-digit number issued by the U.S. Internal Revenue Service (IRS) to individuals who are required for U.S. federal tax purposes to have a U.S. taxpayer identification number but who do not have and are not eligible to get a Social Security number (SSN).

Who Is Eligible To Complete This Form

The following individuals are eligible to complete Form W-7.

Any individual who isn’t eligible to get an SSN but who must furnish a taxpayer identification number for U.S. tax purposes or to file a U.S. federal tax return must apply for an ITIN on Form W-7. Examples include the following.

A nonresident alien individual claiming reduced withholding under an applicable income tax treaty for which an ITIN is required (see Regulations section 1.1441-1(e)(4)(vii)(A)). Also see Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

A nonresident alien individual not eligible for an SSN who is required to file a U.S. federal tax return or who is filing a U.S. federal tax return only to claim a refund.

A nonresident alien individual not eligible for an SSN who elects to file a joint U.S. federal tax return with a spouse who is a U.S. citizen or resident alien. See Pub. 519, U.S. Tax Guide for Aliens.

A U.S. resident alien (based on the number of days present in the United States, known as the “substantial presence” test) who files a U.S. federal tax return but who isn’t eligible for an SSN. For information about the substantial presence test, see Pub. 519.

A nonresident alien student, professor, or researcher who is required to file a U.S. federal tax return but who isn’t eligible for an SSN, or who is claiming an exception to the tax return filing requirement. See Pub. 519.

An alien spouse claimed as an exemption on a U.S. federal tax return who isn’t eligible to get an SSN. See Pub. 501, Dependents, Standard Deduction, and Filing Information, and Pub. 519.

Supporting Documentation Can be used to establish: Foreign status Identity Passport (the only stand-alone document*) x x U.S. Citizenship and Immigration Services (USCIS) photo identification x x Visa issued by the U.S. Department of State x x U.S. driver’s license x U.S. military identification card x Foreign driver’s license x Foreign military identification card x x National identification card (must contain name, photograph, address, date of birth, and expiration date) x x U.S. state identification card x Foreign voter’s registration card x x Civil birth certificate x** x Medical records (valid only for dependents under age 6) x** x School records (valid only for a dependent under age 18, if a student) x** x